Taxes

Setting Up Tax Rates

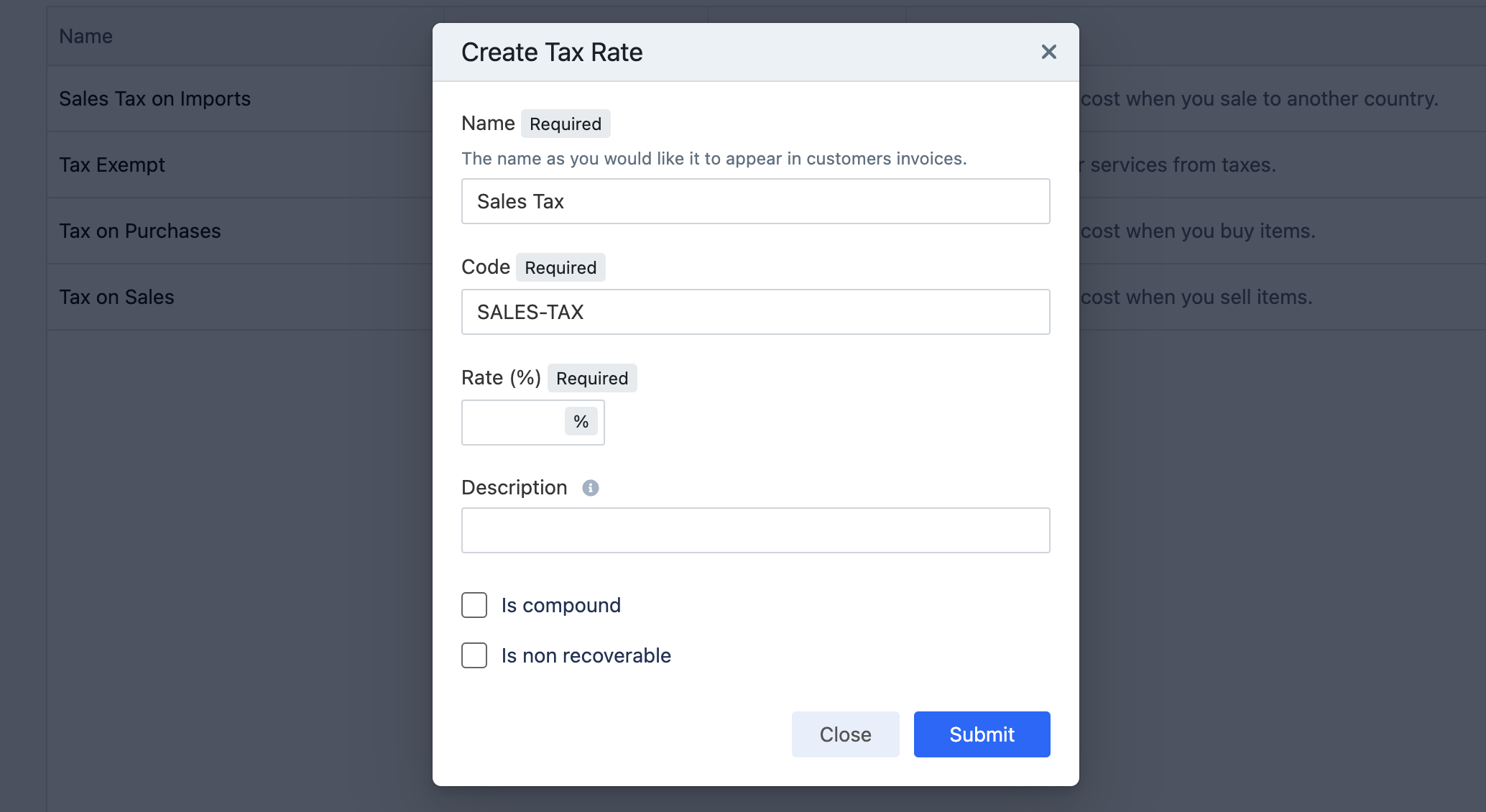

Add New Tax Rate

Add your own tax rates if your organisation needs more options than Bigcapital's default rates. Your tax rates can apply to both sales and purchases.

When you add a tax rate, you'll need to enter a tax name and that name will display on invoices and bills and the tax rate.

To create a new tax rate

- Go to the Financial > Tax Rates, You'll find all the tax rates that defined on your account.

- From the top bar you will find New Tax Rate button to create a new one.

- Fill up the tax name, tax code and tax rate.

- Click Save

Delete Tax Rate

You can delete any tax rate even if it was default tax rate predefined from the system.

- Go to the Financial > Tax Rates.

- Hover above the row and click on tax rate row that you want to delete it to open the tax rate window.

- Click on Delete Tax Rate and click Ok to confirm.

Default tax rates

The most popular used tax rates are already set up in Bigcapital. You can edit them, and add your own custom tax rates.

- Tax on Sales (0%)

- Tax on Purchases (0%)

- Sales Tax on Imports (0%)

- Tax Exempt (0%)

You can see this menu from Financial > Tax Rates

You don't have to use the default tax rate on a transaction. If your tax agency requires a different rate, you can add or edit some default rates and apply these as the default for your items or sales/purchases transactions.

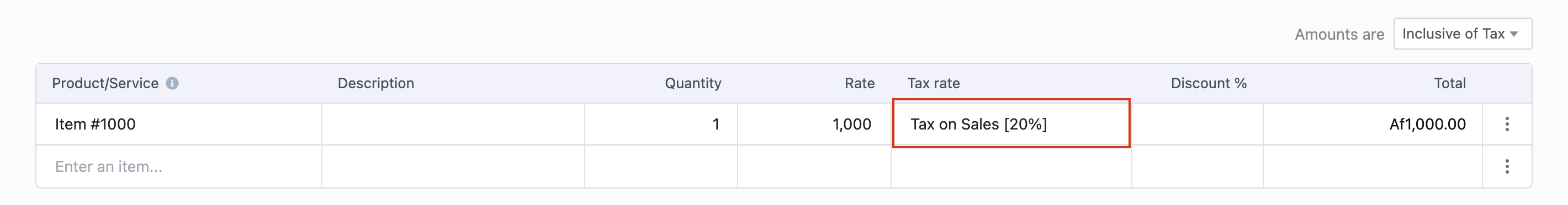

Setup Line Items

Bigcapital calculates sales tax based on the tax rate selected for each item and entered sales transactions into Bigcapital.

Inclusive or Exclusive Tax

Inclusive and exclusive taxes refer to how taxes are calculated and displayed in relation to the base price of a product or service.

Inclusive Taxes: Inclusive taxes mean that the total price of a product or service already includes the tax amount. The displayed or quoted price to the consumer is the final amount they need to pay, which incorporates the product cost and the applicable taxes. In this case, the tax is included within the listed price, and the consumer does not see a separate tax amount during the transaction.

Exclusive Taxes: Exclusive taxes, on the other hand, imply that the displayed or quoted price is only for the product or service itself, and taxes are added on top of this base price during the transaction. The consumer will see the product or service price separately from the tax amount on their receipt or invoice. The tax is calculated and added at the point of sale or payment.

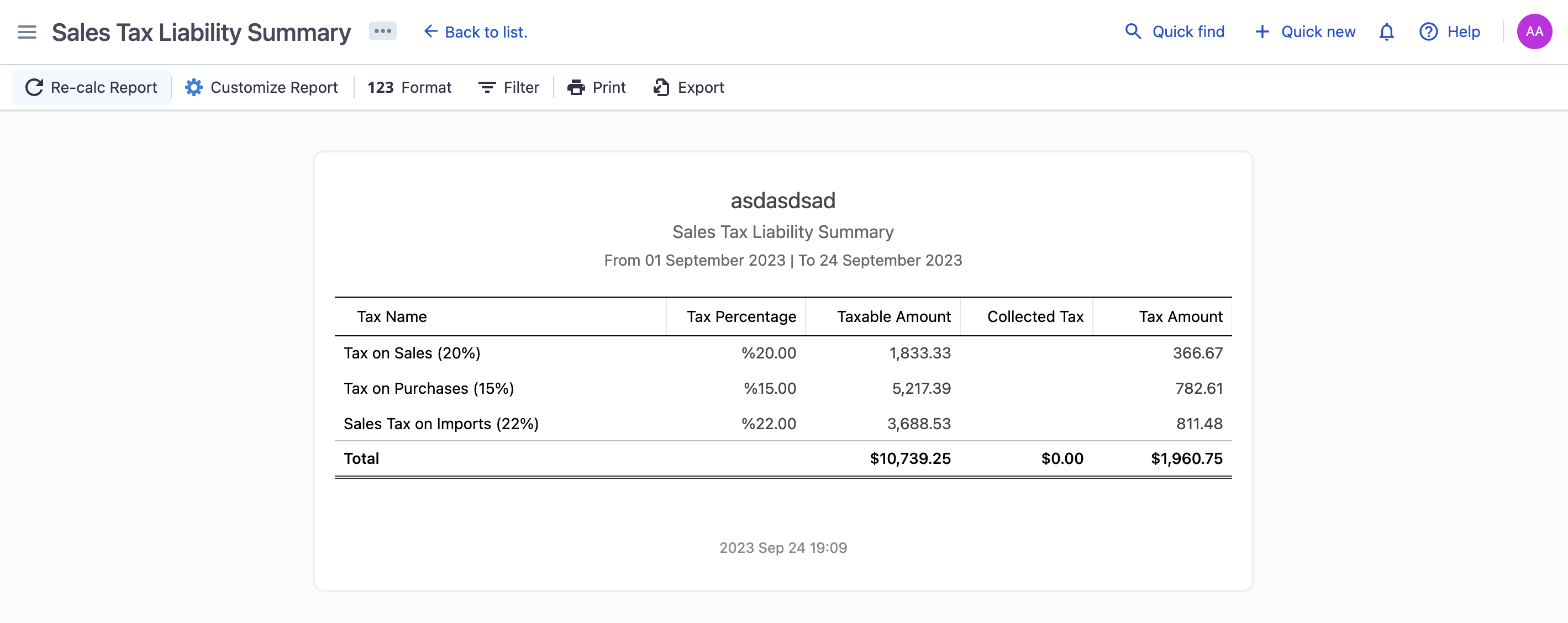

The Sales Tax Liability Summary report

Sales tax liability summary report provides overview of the taxes incurred on all sales transactions. This report allows you to see the amount of taxes collected, that taxes amount that the organization should pay over a specific time frame.

To view sales tax liability summary report.

- Go to Reports > Sales Tax Liability Summary report.

FAQs

Can I delete the taxes that applied to other transactions?

Deleting the tax associated with your past transactions won't effect the past transactions. If you find that a tax you've created is no longer useful for your business, you can confidently delete it without concerns about its effect on your historical transactions.